The annual fiscal report for 2018 shows a notable decrease in suspicious economic activity in the Vatican Bank, the IOR and other Holy See institutions.

In 2015, potential irregularities were detected in 544 of the Vatican's financial transfers. However, last year only 56 were found. The collaboration with foreign entities has increased. Additionally, protocols required for international banking transparency systems have been updated.

The only preventive measures the Vatican's financial supervisory has had to make is to block two accounts for five days. They have also had to prevent three transactions.

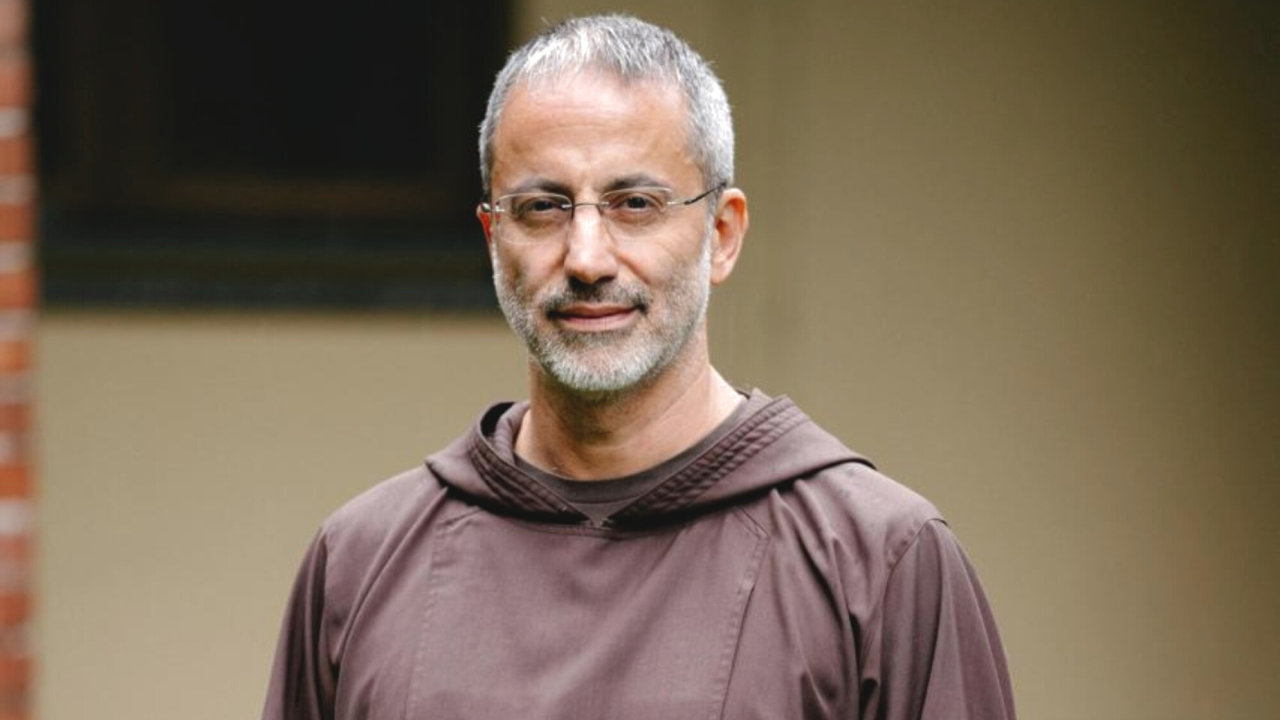

RENÉ BRÜLHART

President, Financial Information Authority

“I think it's very positive what has been achieved so far. However. I guess, there is never, ever, a kind of mission accomplished.” “I think the importance here is that we have instruments and measures that have been put in place, which allows us to tackle these kinds of challenges as such.”

TOMMASO DI RUZZA

Director, Financial Information Authority

“We are perhaps less concerned than other authorities. However, this does not mean that there is no need to maintain political strategies and very preventive measures as we said before.”

With this report the Holy See intends to show its commitments to obeying international regulations in the fight against money laundering.

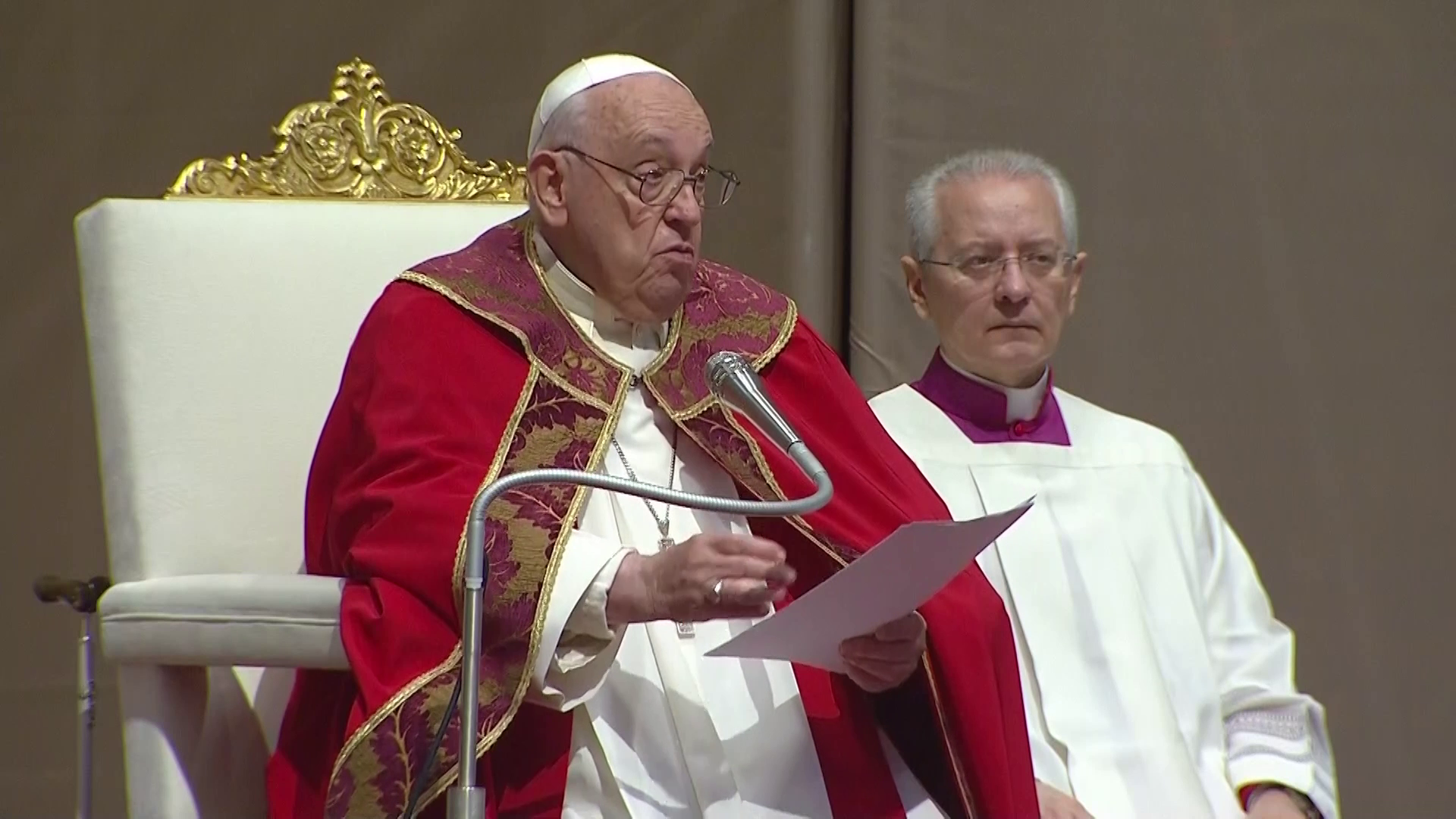

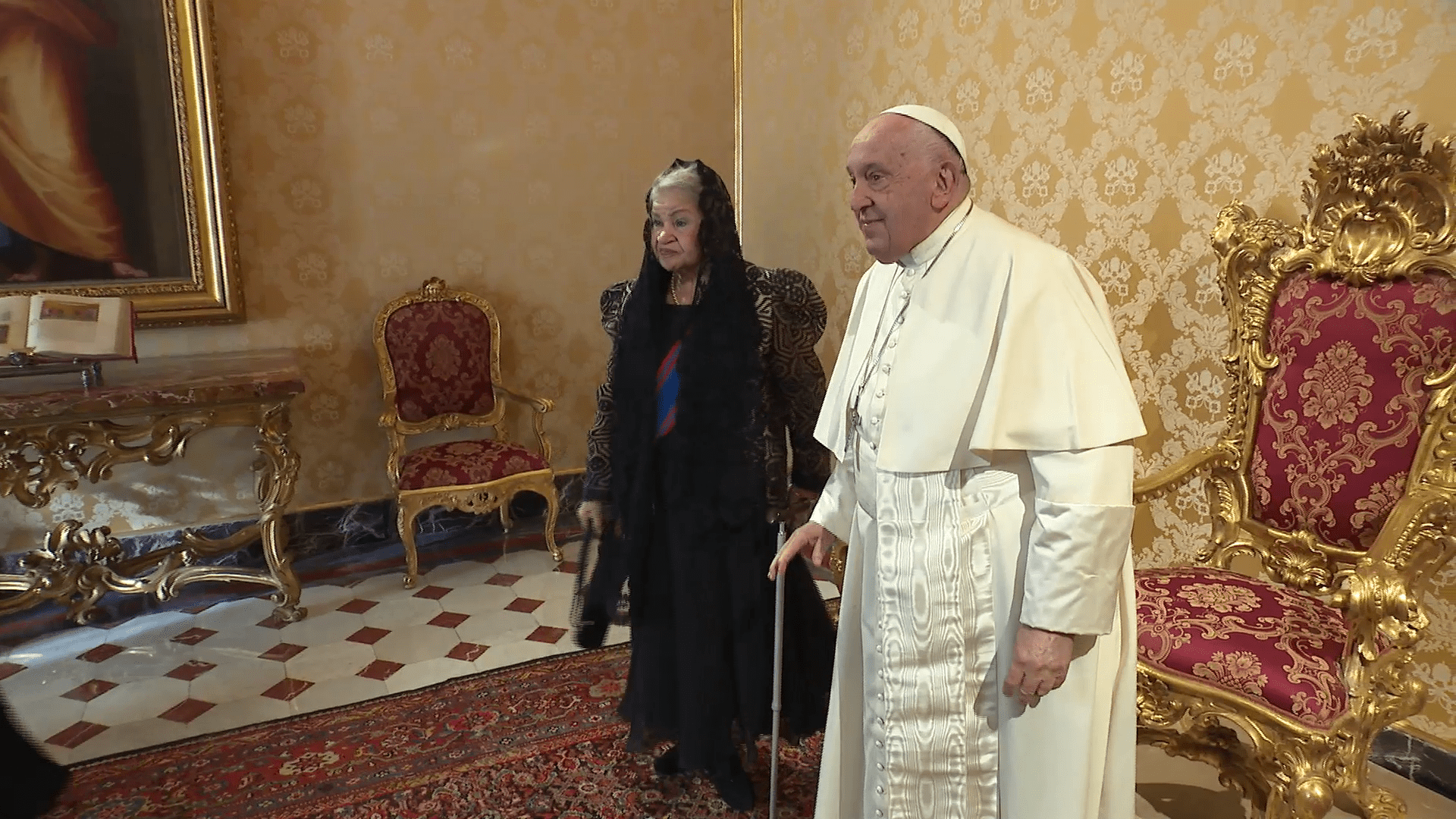

It was Benedict XVI who took this initiative in 2009. He wanted the Holy See to join the international transparency protocols. Pope Francis is also following through with this objective, is so the Vatican's financial system is an example too the rest of the world.